Here we show use cases and applications of StratePlan Superintelligence

Use Cases & Areas of Application

How StratePlan Transforms Complex Decisions

With StratePlan, you'll experience how data-driven superintelligence can optimize even the most complex decision-making processes.

On this page, we show you practical use cases in which StratePlan is already being used today – from infrastructure planning and budget management to resource allocation in industry, administration, and large-scale projects.

What all use cases have in common:

- Billions of possible scenarios – analyzed in seconds

- 20–60% greater impact with the same budget

- Mathematically sound, risk-adjusted recommendations

Strategically optimal resource allocation at the touch of a button

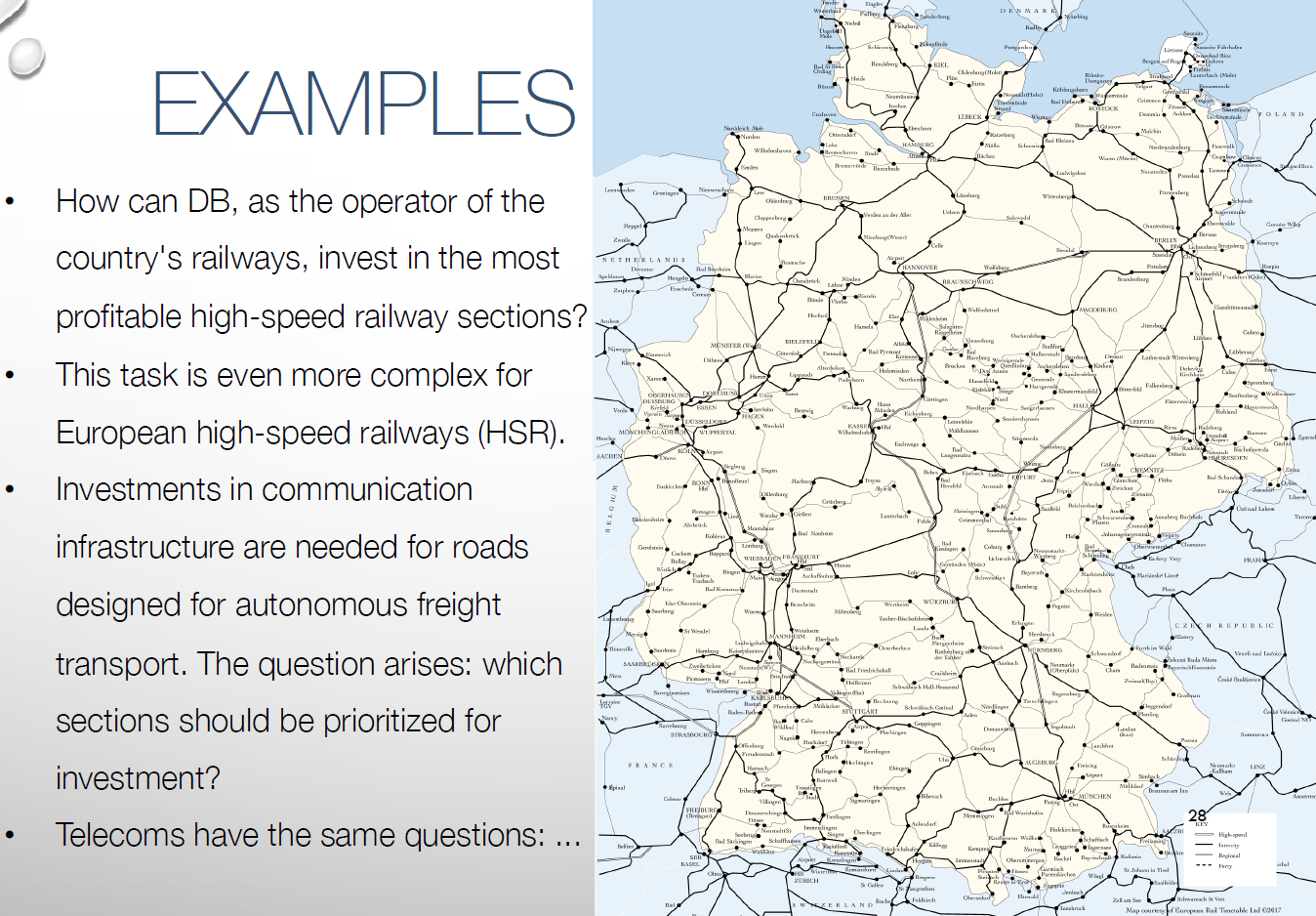

Whether it's selecting the most profitable high-speed lines, prioritizing public investments, or strategically bundling projects:

StratePlan recognizes where your capital will have the greatest impact.

Maximum effect

StratePlan: More impact. Less effort.

In times of scarce resources and growing complexity, one central question is crucial:

How do you achieve the greatest possible impact with a limited budget?

The answer lies in a new generation of decision intelligence:

StratePlan – the superintelligence for financial decisions.

Maximum ROI

Strateplan cuts through billions of scenarios to reveal what others overlook: hidden synergies, harmful overlaps, and the smartest way to allocate your resources for maximum impact.

Maximum project impact

Don’t just invest smart – invest strategically.

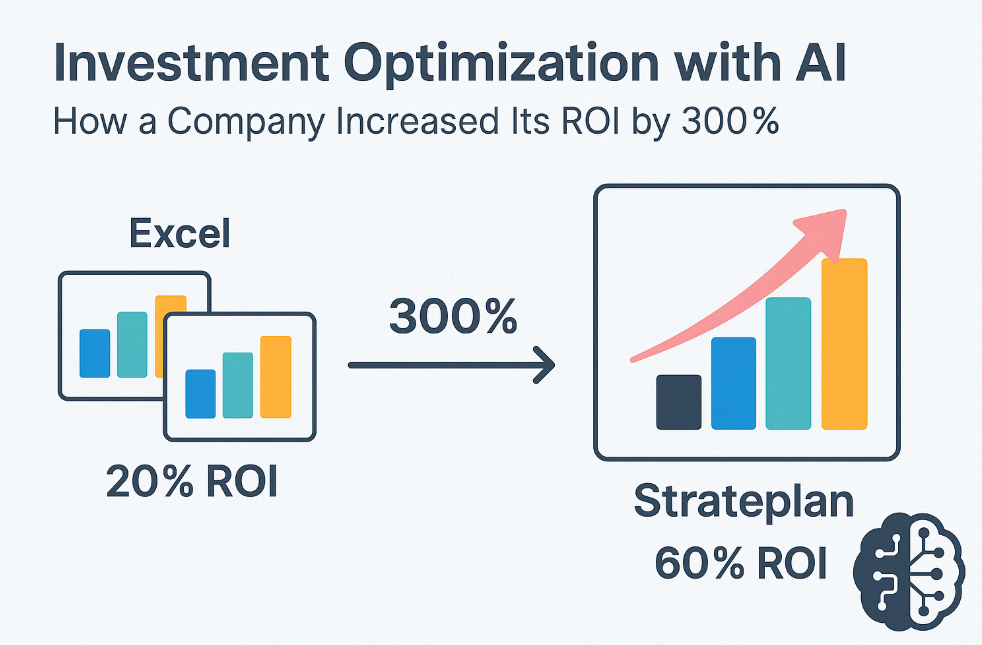

Strateplan turns isolated project logic into synergistic impact – boosting your ROI from 20% to 60% (+300%) or beyond.

Allocation AI at the highest level

Computing power, intelligence and experience combined in a superintelligence made in Worms. Rheinhessen. Germany.

Investment optimization reimagined: How a company increased its ROI by 300% with StratePlan Superintelligence

A practical example of investment maximization through unrecognized synergies and strategic connections

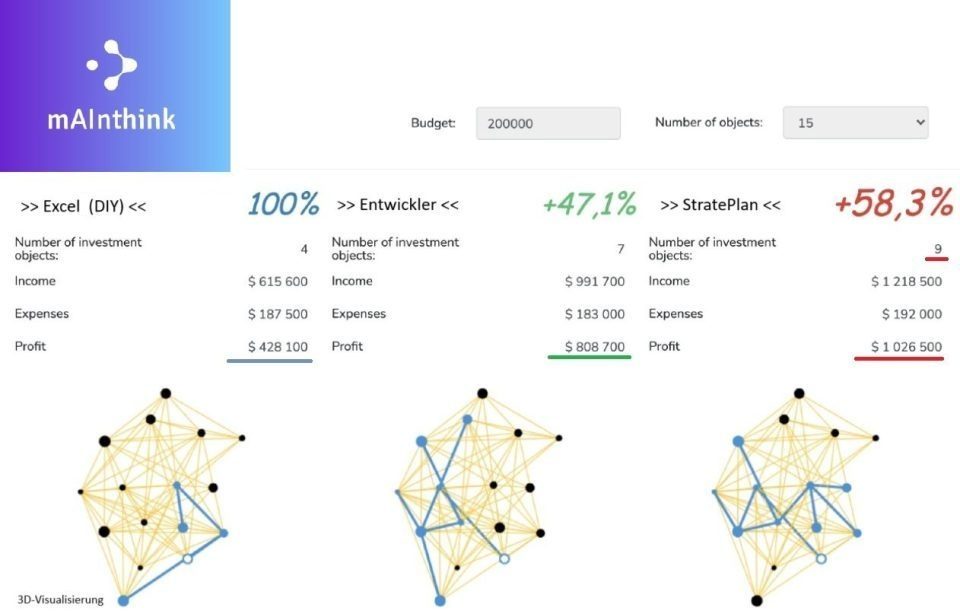

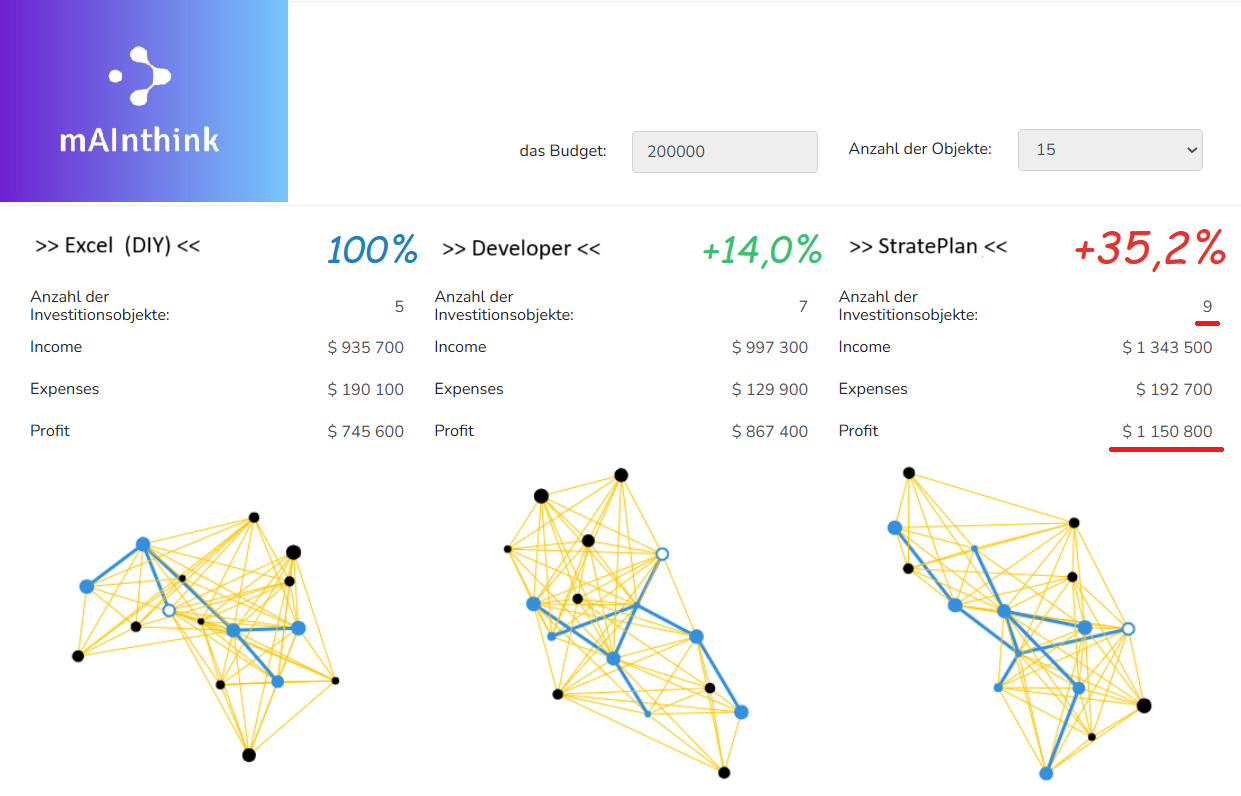

Initial situation: 34 investment projects, but insufficient budget

A medium-sized manufacturing company faced a classic investment decision: It wanted to invest in 34 potentially profitable projects – from new machinery to digitalization projects to infrastructure measures.

But there was a problem:

The available budget was €2,800,000, and the total required was €4,500,000. This meant that not all projects could be implemented simultaneously – prioritization was required.

Conventional Approach: Excel-Based Investment Appraisal

The company attempted to use Excel to select the optimal projects, combining the most profitable projects within the budget. The result:

- 20% expected return on investment (ROI)

- No consideration of synergies, internal friction, or negative interactions between projects

- The analysis was based on isolated project evaluations – without networking the measures

The real challenge: 17 billion possible combinations

What many people don't consider: With 34 projects, this results in 2³⁴ = 17,179,869,184 possible combinations.

A complete analysis of all scenarios is practically impossible with conventional tools.

This is where StratePlan comes in – our proprietary AI-based superintelligence for investment optimization and strategic decision-making.

StratePlan doesn't just analyze numbers – it identifies what really works

Strateplan goes far beyond traditional investment calculators. The platform not only analyzes the individual economic evaluation of projects, but also identifies:

- Synergies between projects

- Cannibalization effects, where projects take away each other's benefits

- Silo thinking that inefficiently ties up resources

- Hidden efficiency potential that only unfolds through interaction

The result: An ROI jump from 20% to 60%

After deploying StratePlan, an impressive result emerged:

- The AI selected a project combination that was not included in the Excel model.

- By specifically selecting strategically connected projects, the expected ROI increased to 60%.

- The company was able to achieve greater impact with the same budget.

Why investment maximization no longer works without AI

In a complex world with limited resources, traditional project evaluation is no longer sufficient. Those who want to achieve true investment maximization must:

- Uncover unrecognized synergies

- Eliminate hidden friction

- Think holistically instead of just summing things up

Conclusion: Increased ROI through unrecognized synergies and seamless strategy development

StratePlan has shown:

The key to successful investment planning lies not in better numbers or cutting the objects or extend the budget, but in better connections between the numbers to optimally allocate budget to get greatest possible ROI.

Those who network their projects rather than just evaluate them achieve greater impact with fewer resources.

Discover StratePlan now and manage investments intelligently.

Leverage the power of our AI to get the most out of your projects.

👉 Schedule a demo now or test Strateplan in your organization.

More impact. More ROI. Less friction.

StratePlan: Optimize investment decisions & increase project impact – with AI support

In times of tight budgets and increasing complexity, one question is becoming increasingly pressing:

How can the impact of investments be specifically increased?

Whether in companies, public administration, or corporate environments – resources are limited, expectations are high, and bad decisions are costly.

This is precisely where StratePlan comes in: an AI-supported superintelligence that not only safeguards investment decisions – but also strategically optimizes and prioritizes them.

Rethinking Project Prioritization

Anyone with multiple investment options knows the dilemma:

What comes first? What yields the most value? What can wait – and what should definitely not be overlooked?

StratePlan analyzes all relevant parameters, goals, budgets, and constraints – and calculates the best possible sequence and combination of your projects in seconds.

Intelligent project prioritization creates maximum impact with minimal capital investment – transparent, objective, and transparent.

Optimize investment decisions – with AI

StratePlan uses sophisticated optimization algorithms and artificial intelligence to simulate, evaluate, and improve investment decisions based on data.

- Billions of scenarios analyzed in seconds

- Budget allocations suggested with maximum ROI

- Risks, synergies, and trade-offs considered

- Visual presentation for CFOs, decision-makers, and stakeholders

The result: Investments based on hard fact data planning – instead of spray and pray

Increase ROI with AI and superintelligence

With StratePlan, you not only achieve greater efficiency – you demonstrably achieve greater impact from existing capital.

Real-life examples:

- ROI increase from 20% (before calculated by Excel DIY) to over 60% (+300% more profit) through smart allocation

- Reduction of ineffective measures by up to 70%

- Identification of hidden synergies & efficiency levers

The combination of AI, ROI calculation, and strategic logic makes StratePlan a unique tool for modern organizations.

Conclusion: Effect is what counts – not volume

StratePlan is changing the way we think about investments.

It's not the biggest budget that wins – it's the best allocation of resources.

with intelligent project prioritization, data-driven decision-making logic, and a clear focus on impact, StratePlan helps companies and organizations realize their full potential.

Is an additional ROI of +50% or +60% possible?

With StratePlan, yes.

The question of whether a return on investment (ROI) of +50% or even +60% is realistic sounds like a bold statement at first glance.

But modern technologies and data-driven methods like StratePlan show:

Yes, such a high ROI is not only possible, but under certain conditions, it is clearly calculable – and has already been achieved in practice.

What is ROI anyway?

ROI (Return on Investment) measures the financial success of an investment relative to the capital invested.

Formula for calculating ROI:

(Profit / Investment Cost) × 100 = ROI in %

An example:

- Investment: €100,000

- Profit from it: €50,000

- ➜ ROI = (50,000 / 100,000) × 100 = 50%

Those who want to calculate a practical ROI example usually use simple tools like an ROI calculation in Excel – useful for a small number of projects, but quickly overwhelming for more complex scenarios with many variables.

Where Excel reaches its limits, StratePlan begins and adds unseen ROI into account.

Traditional ROI investment calculations work well for individual measures.

But what if you:

- want to evaluate multiple investments simultaneously?

- have interdependencies between projects?

- need to prioritize budgets?

- want to consider long-term impacts and risks?

- want to find out where is the cannibalization?

- want to find out the friction between projects?

This is where StratePlan comes in – the superintelligence for data-driven investment strategy.

StratePlan analyzes billions of scenarios in seconds and delivers the combination of measures with the highest ROI

Is a additional +50% ROI possible? Yes, if you combine things wisely.

An ROI of +50% is absolutely possible if:

- Projects with high return on investment are identified and prioritized

- Inefficient measures are eliminated

- Synergy effects and interactions are considered

- Resources are allocated in a targeted manner – this is precisely what StratePlan was developed for

And even an ROI of +60% is achievable under certain conditions – e.g., by systematically bundling high-impact projects and avoiding internal cannibalization effects.

ROI calculation in Excel? Or with superintelligence?

While an ROI calculation in Excel makes sense for clear, simple cases, it quickly becomes confusing when there are more than five projects.

StratePlan was developed precisely for this purpose: for complex investment decisions with high capital impact.

The advantages:

- Up to +60% more impact with the same budget

- Scenarios at the touch of a button – instead of weeks of spreadsheets

- Transparent decision-making logic for CFOs and project managers

- Integration into existing processes and systems

Conclusion: If you really want to increase your ROI, you need precision

The question "Is an ROI of +50% or +60% possible?" is therefore not a matter of chance – but of analytical and decision-making skills.

StratePlan provides the basis for this – and shows which measures are truly worthwhile.

With StratePlan for intelligent ROI analysis – How to achieve up to +60% more return on total capital

In modern business management, every decision counts. But how can companies ensure that investments are not just well-intentioned but also measurably profitable? The answer: an intelligent, data-driven ROI analysis that makes the actual return on investment visible – and maximizes it.

This is precisely where StratePlan comes in – the super-intelligence of mAInthink, developed for companies that want to raise the ROI of their projects to a new level.

What does ROI mean in business administration? And what ROI StratePlan can reach within limited budgets for fixed assets?

Return on investment (ROI) is one of the most important business metrics. It shows how efficiently a company uses its capital to generate returns.

Example calculation (return on total capital):

Profit / invested capital × 100 = ROI in %

An ROI of 20% means that for every euro invested, a return of 20 cents was achieved. But how about an ROI of +30%, +40%, +50%, or even +60%?

With StratePlan, even more ROI is possible – without additional capital, simply through intelligent allocation of existing resources and finding of unseen ROI´s and synergies.

StratePlan: The maximum return on investment calculator with AI

StratePlan goes far beyond traditional ROI tools or spreadsheets. The software analyzes billions of investment scenarios in seconds and shows you:

- Which projects deliver the highest possible return on investment

- How to prioritize budgets

- Which combinations of measures deliver the highest overall return

Whether you want to conduct an ROI analysis for individual projects or a holistic return on investment calculation – StratePlan provides reliable data that you can build on strategically.

ROI of 20%? StratePlan can do more

Many companies aim for an ROI of 20% – a solid goal. But with data-driven allocation and simulation intelligence, significantly higher values are possible.

Our users report:

- ROI of +30% for regional infrastructure projects

- ROI of +40% in municipal investment planning

- ROI of +50% for company-wide transformation programs

- And in individual cases, even an ROI of +60% through optimized project bundling

- In some cases StratePlan reaches +100% effect for project management szenarios

StratePlan not only considers short-term returns, but also analyzes synergy effects, dependencies, and long-term impact.

ROI analysis as a decision basis for CFOs and strategists

The days of experience-based decisions or Excel estimates are over. Modern business management requires precise models – ideally visualized, scalable, and fully traceable.

StratePlan is therefore more than an ROI calculator. It is a strategic decision-making tool:

- For CFOs who want to accurately approve budgets

- For controlling teams that need to make efficiency measurable

- For management teams that prioritize impact over volume

Conclusion: Increasing ROI means making smarter decisions

With StratePlan, you not only achieve better results, but also create strategic clarity, transparency, and impact.

Make optimal use of your resources – for greater profitability, greater impact, and maximum decision-making quality.

Try StratePlan now – and discover how close you can get to an ROI of +60%.

StratePlan in practice: Top-down meets bottom-up – super-intelligent decisions in both directions

In modern organizations, investment decisions aren't just a matter for the CEO – they arise from the tension between strategic leadership and operational needs. But how can centralized budgets and decentralized requirements be meaningfully combined?

StratePlan, the AI-based superintelligence for investment planning and budget allocation, offers a novel solution:

Top-down and bottom-up logic in one system.

Top-Down: Strategic budget management with maximum ROI

From a top-down perspective, StratePlan is specifically aimed at the management level, especially CFOs, CEOs, division heads, or group managers.

The task:

Use capital specifically where it will have the greatest impact – taking risks, strategies, and corporate objectives into account.

With StratePlan, decision-makers receive:

- A data-driven basis for budget approvals

- Recommendations for optimal resource allocation across business units

- Clarity regarding returns, priorities, and the effectiveness of planned measures

- Simulations of investment scenarios, e.g., with limited capital or changing market conditions

Result: Strategic management based on numbers – without flying blind, without lobbying pressure, without Excel compromises.

Bottom-up: Intelligent budget requests from the departments

At the same time, StratePlan also supports the operational levels – project managers, specialist departments, business units, or external partners.

The challenge here:

How can I submit a well-founded budget request based on impact?

StratePlan offers:

- Intelligent evaluation of individual measures based on impact & ROI

- Ability to calculate various project combinations

- Simple preparation for CFOs and decision-makers to approve budgets

- An objective comparison with alternative options or timeframes

Result: Bottom-up requests with robust justification that not only convince decision-makers – but also relieve strategic pressure.

Two perspectives – one solution

What makes StratePlan unique:

It combines both ways of thinking – top-down goals with bottom-up knowledge. This creates a shared understanding of the system that paves the way for:

- greater transparency

- better decisions

- and more efficient use of resources

paving – without friction between levels.

Conclusion: Intelligent planning needs both directions

Top-down sets the direction. Bottom-up delivers reality.

With StratePlan, both become a powerful management system – data-driven, flexible, and highly scalable.

Whether you decide or submit a request: StratePlan thinks along with you. And goes further.

Maximum impact in marketing: How StratePlan optimizes advertising for ROI

Marketing budgets are tight, advertising channels are diverse, and target groups are more demanding than ever. The key question, therefore, is:

How do we achieve maximum impact with the available budget?

StratePlan, the AI-powered superintelligence for budget and project optimization, provides a clear answer:

Through data-driven, mathematically sound decisions. This applies to marketing, too—and especially so—in marketing.

The Challenge: Impact over Volume

Many marketing departments struggle with the same problems:

- Too many options, too little clarity

- Campaign wastage

- Unclear impact of individual measures

- Decision-making pressure with tight budgets

- Inadequate linking of goal, channel, and return

StratePlan transforms these uncertainties into robust recommendations. Instead of investing based on Excel or experience-based decisions, every marketing decision is based on ROI potential and impact simulations.

StratePlan for Marketing: How it Works

StratePlan analyzes millions of campaign combinations, budget amounts, timing, and channels – and calculates which combination of measures will yield the highest return with the available budget.

This takes into account:

- Target group precision and reach

- Costs per channel/medium

- Synergy effects between measures

- Seasonality and timing

- Conversion rates and historical performance data

- Strategic corporate goals (e.g., brand building vs. lead generation)

Result: An advertising strategy optimized for impact – with maximum return on investment.

Practical example: One budget, four scenarios

A company wants to invest €500,000 in international product launch marketing. Instead of commissioning a traditional media planning service, it uses StratePlan.

StratePlan Superintelligence simulates:

- TV + Social Media

- Influencers + Display

- Events + Google Ads

- Content + Native Advertising

StratePlan shows:

- Scenario 1: Allocation manually by Excel. Expected ROI ~26%

- Scenario 2 generates +38% more qualified leads with the same budget – and increases the ROI from 26% to +41%.

From gut feeling to strategy

StratePlan doesn't replace creativity – but it does make marketing decisions measurable and sound.

It supports CMOs, marketing teams, and agencies in allocating budgets as a CFO would expect:

based on impact, based on numbers, based on efficiency.

Conclusion: Advertising may cost money. But it has to be effective.

With StratePlan, you don't just use your marketing resources – you invest them purposefully.

For greater impact, more transparency, and more success per euro invested.

Case study: StratePlan Superintelligence for strategic navigation of businesses and governments

We show you the hidden synergies and winnings (not only monetary)

Objective

- To ensure that allocation and budget decisions are no longer based on shaky Excel constructs or gut feeling.

- To avoid post-hoc justifications in the event of incorrect decisions ("Why did you allocate the budget like that back then?").

- Top-down and bottom-up approaches are equally integrated – without contradictions, but synchronized via data.

- In the event of external changes (market, regulation, costs, supply chain, trends), a new strategic course is automatically proposed – comprehensible and with a path to action.

Key features of StratePlan superintelligence

Data-Driven Allocation for maximum effect

- Analysis of all relevant company data (revenue, margins, team performance, project efficiency, trends, taxes).

- Automated allocation of budgets and resources according to defined target systems.

- Every euro is "justified" by KPIs.

Strategic Course Navigator

- The strategic course is dynamic and recalculated when changes occur.

- Decisions are made not based on gut feeling, but based on a model – like an airplane's autopilot.

- What-would-have-been analyses are available at any time (What would have happened if we had budgeted differently?).

Risk Minimization

- Early detection of strategic dead ends.

- Suggestions for realistic reallocation before critical thresholds are reached.

- Elimination of the Excel planning bubble ("Excel looks good, but reality tells a different story").

Transparency and Traceability

- All decisions are versioned, justified, and documented.

- No room for "Who decided that and why?" Every course is justified in the StratePlan system.

- Superintelligence models also automatically evaluate external factors (market data, competitors, economic situation, and much more).

Top-down & bottom-up synchronization

- The system compares specifications from the top (vision, strategy) with feedback and data from the bottom (operational reality).

- Conflicts are not blurred, but resolved – with suggested solutions.

Result

- Companies steer by sight, using radar, rather than gut feeling and the rearview mirror.

- Stakeholder alignment through complete strategy transparency.

- No more "failure" due to black-box planning or Excel monsters.

- Every step is strategically justified, documented, and adaptable at any time.

Set course now – with StratePlan superintelligence

Whether you're a company or a government: anyone who wants to act strategically today needs more than plans – they need an intelligent navigation system.

Ready for data-driven decisions? Contact now!

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte überprüfen Sie die Details in der Datenschutzerklärung und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.